The Effect of War on Silver

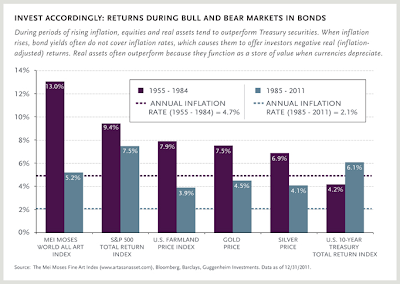

Silver ( PSLV , SLV ) is one of the most thermally and electrically conductive materials on this world. Silver is also the best light reflecting element. Silver is being used for war equipment like aircraft and tank engines , automobiles , electrical connections , guns , torpedoes , radiator connections , rockets , warheads , submarines . In fact, silver is essential during wartime periods. Silver-Investor.com points out: "Notice that in a wartime period, silver use increases dramatically. In the nearly 63 years since that review was issued, no substitute has been found in nature for silver and its fantastic characteristics. Many revolutionary uses for silver were discovered as a consequence of war industry research, and what was true in 1942 is truer still today. A modern war machine MUST have silver to function at peak efficiency. Aerospace and jet aircraft technology could not exist without silver, nor could missiles and satellites. Countries which don't have adequate silve...