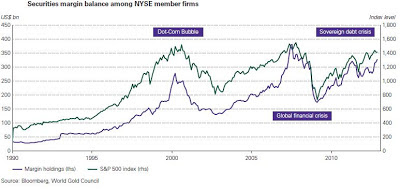

Correlation: Margin Lending Vs. Stock Valuation

I came across an interesting correlation: Margin Lending Vs. S&P. Margin loans are programs that allow investors to borrow money to buy equities. So if you think through it: the higher the margin balance in the market, the higher the S&P will go, because people will have more borrowed money to put in the stock market. Today, the total margin balance is at $350 billion for NYSE member firms. The evidence is presented on Chart 1. You can see that there is no lag between the two charts, so it's a rather useless correlation to time the market. Chart 1: Margin Balance Vs. S&P Although fairly useless, sometimes there are discrepancies that can be spotted. For example, the rising Australian stock market could be overvalued at this moment when you look at their declining margin lending rate (Chart 2). So it can be interesting to watch this correlation. Chart 2: Margin Balance Vs. ASX200