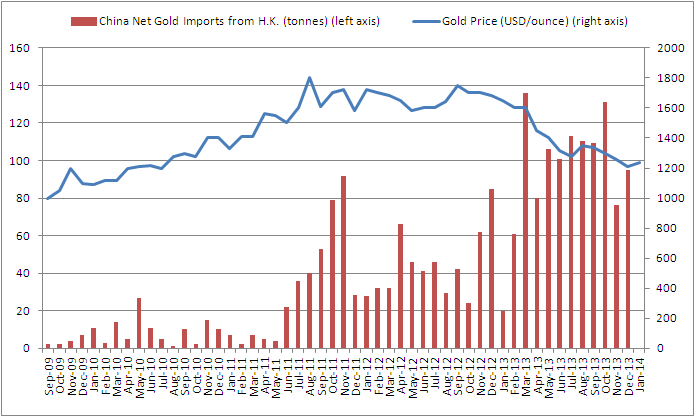

2013 A Magnificent Year For China Gold Imports

In 2013, China imported net 1140 tonnes of gold from Hong Kong. Which is a huge increase (110%) from the 532 tonnes imported in 2012. Other than Hong Kong, China also imported approximately 420 tonnes from other countries. So total gold import to China is around 1600 tonnes. If gold production ex China is around 2300 tonnes, then China imports almost all the gold that the world produces (ex China). The gold price went from $1700/ounce (2012) to $1300/ounce (2013) on average. That's a decrease of 25%. So a 25% drop in gold price makes the Chinese buy double as much gold. If the gold price were to drop another 25% to $1000/ounce, then China would import 3200 tonnes a year which exceeds global mine supply of 2300 tonnes (ex China). This is of course not sustainable and that's why gold can't go to $1000/ounce. It's virtually impossible. Do as Marc Faber says and buy the junior gold mines GDXJ (cfr. Barron's Roundtable).