Fed Rate Cut is 100% Locked In

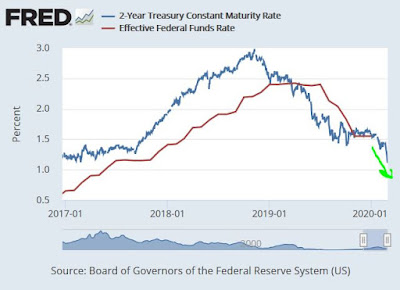

When we check the 2 year bond yield, we can be 100% sure that the Fed will cut rates in March 2020. Remember what happened in 2019 when the Fed cut rates? Gold went from $1300/ounce to $1600/ounce. I expect this to happen again, learn from history.