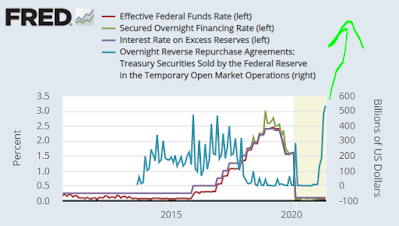

The limit of $500 billion has been exceeded on the reverse repo operations. This tells me there is an imminent USD collapse. Also, the Fed won't hike rates because it has too many bonds which they would need to pay interest on. So the first thing that will have to happen is tapering of bond purchases . The Fed purchased 54% of the $4.6 trillion increase in the Treasury’s publicly held debt from February of last year through April 2021. The Fed now holds a record 25.7% of the Treasury’s outstanding publicly held debt. And for tapering to happen, Biden needs to stop issuing new infrastructure bills, mortgage moratoria and unemployment checks. Moreover, tapering can only start when lending increases (which it isn't, see chart below), because when you taper, bond yields will rise and lending stops.