Update: List of all Correlations

I have found many correlations since I started blogging in January 2012.

So I wanted to summarize once again all correlations in this update. Positive correlations mean that if one goes up, the other goes up too. Negative correlations mean that if one goes up, the other goes down.

Positive correlations:

1) Silver premium Vs. Silver Price

2) Baltic Dry Vs. Industrial Commodities

3) Baltic Dry Vs. Copper

4) Copper Vs. S&P

5) Oil Vs. Dow Jones

6) Agriculture Price Vs. Health of Economy

7) Agriculture Vs. Fertilizer Price

8) CRB Index Vs. Commodity prices (oil, agriculture, metals)

9) MZM velocity Vs. Inflation

10) MZM velocity Vs. 10 year U.S. treasury yield

11) Case-Shiller Index Vs. Housing Market Index

12) Capacity Utilization Vs. Inflation

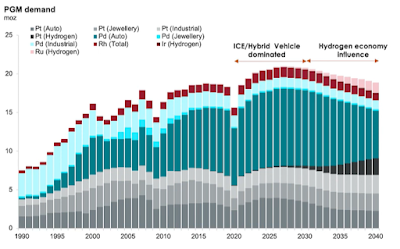

13) Rhodium Price Vs. Automotive Industry

14) Housing Price Vs. Rise of Wages

15) O-metrix Score Vs. Stock Value

16) Outlay Spending Vs. Hyperinflation

17) Gold Money Index Vs. Gold Price

18) Stock Dividend to Bond Yield ratio Vs. Stock Price

19) War Vs. Silver Price

20) Exchange Rate Vs. Treasury Bond Valuation

21) PMI Vs. GDP Growth Rate

22) Gold Lease Rate Vs. Gold Price

23) Economy of Australia/Canada Vs. Industrial Commodities

24) Jim Sinclair's Fed Custodials Vs. Gold Price

25) LCNS silver net short positions Vs. Silver Price

26) ECB Deposit Rate Vs. Euribor and Deposit Facility

27) China Gold Imports from Hong Kong Vs. Gold Price

28) AUD/USD Vs. Iron Ore

29) Chinese yoy GDP growth Vs. Chinese yoy Power Consumption

30) Chinese yoy Power Consumption Vs. Chinese yoy Power Production

31) M1 and Gold

32) Obesity Vs. Debt

33) Global Equity Prices Vs. Global EPS revisions

34) Total Public Debt Vs. Interest Payment on Debt

35) U.S. Bond Yields Vs. Interest Payment on Debt

36) Federal Reserve Balance Sheet Vs. S&P

37) Federal Reserve Balance Sheet Vs. Gold Price

38) Balance Sheet Ratio Fed/ECB Vs. EUR/USD

39) China Manufacturing PMI Vs. Base Metal Prices

40) COMEX stock level Vs. CFTC Open Interest

41) Manufacturing component of Industrial Production Vs. CRB Metals Index

42) Net Short Interest Gold Vs. Gold Price

43) Central Bank Net Gold Buying Vs. Gold Price

44) LCNS silver Vs. Silver Open Interest

45) Bond Yields Vs. Gold Price

46) Gold Miners Bullish Percent Index Vs. GDX

47) Daily Sentiment Index Gold Vs. Gold Price

48) Commercial Net Short Interest Vs. Silver Price

49) Food Stamp Participation Rate Vs. Unemployment Rate

50) Bitcoin Price Vs. Gold Price

51) Credit Expansion Vs. Economic Health

52) Gold Volatility Vs. Gold Price

53) Total Stock Market Index Vs. GDP

Negative correlations:

1) Copper Price Vs. Copper Futures Contango

2) Interest Rates Vs. P/E ratio of gold mines

3) Non-Farm Payrolls Vs. Unemployment Rate

4) Federal Debt Held by Foreigners Vs. U.S. Bond Yields

5) Size of Governments Vs. Their Economies

6) Stocks Vs. U.S. Dollar

7) Silver Stock at CME Vs. Silver Price

8) China Reserve Requirements Vs. Shanghai Real Estate Prices

9) Capacity Utilization Vs. Unemployment Rate

10) Net Commercial Short Positions Vs. Bond Yields (Alternative Site)

11) Net Non-Commercial Long Positions Vs. Bond Yields

12) % Change in Gold Vs. Real Interest Rates on 10 Year Treasuries

These are a lot of correlations that you need to monitor on a day to day basis!

So I wanted to summarize once again all correlations in this update. Positive correlations mean that if one goes up, the other goes up too. Negative correlations mean that if one goes up, the other goes down.

Positive correlations:

1) Silver premium Vs. Silver Price

2) Baltic Dry Vs. Industrial Commodities

3) Baltic Dry Vs. Copper

4) Copper Vs. S&P

5) Oil Vs. Dow Jones

6) Agriculture Price Vs. Health of Economy

7) Agriculture Vs. Fertilizer Price

8) CRB Index Vs. Commodity prices (oil, agriculture, metals)

9) MZM velocity Vs. Inflation

10) MZM velocity Vs. 10 year U.S. treasury yield

11) Case-Shiller Index Vs. Housing Market Index

12) Capacity Utilization Vs. Inflation

13) Rhodium Price Vs. Automotive Industry

14) Housing Price Vs. Rise of Wages

15) O-metrix Score Vs. Stock Value

16) Outlay Spending Vs. Hyperinflation

17) Gold Money Index Vs. Gold Price

18) Stock Dividend to Bond Yield ratio Vs. Stock Price

19) War Vs. Silver Price

20) Exchange Rate Vs. Treasury Bond Valuation

21) PMI Vs. GDP Growth Rate

22) Gold Lease Rate Vs. Gold Price

23) Economy of Australia/Canada Vs. Industrial Commodities

24) Jim Sinclair's Fed Custodials Vs. Gold Price

25) LCNS silver net short positions Vs. Silver Price

26) ECB Deposit Rate Vs. Euribor and Deposit Facility

27) China Gold Imports from Hong Kong Vs. Gold Price

28) AUD/USD Vs. Iron Ore

29) Chinese yoy GDP growth Vs. Chinese yoy Power Consumption

30) Chinese yoy Power Consumption Vs. Chinese yoy Power Production

31) M1 and Gold

32) Obesity Vs. Debt

33) Global Equity Prices Vs. Global EPS revisions

34) Total Public Debt Vs. Interest Payment on Debt

35) U.S. Bond Yields Vs. Interest Payment on Debt

36) Federal Reserve Balance Sheet Vs. S&P

37) Federal Reserve Balance Sheet Vs. Gold Price

38) Balance Sheet Ratio Fed/ECB Vs. EUR/USD

39) China Manufacturing PMI Vs. Base Metal Prices

40) COMEX stock level Vs. CFTC Open Interest

41) Manufacturing component of Industrial Production Vs. CRB Metals Index

42) Net Short Interest Gold Vs. Gold Price

43) Central Bank Net Gold Buying Vs. Gold Price

44) LCNS silver Vs. Silver Open Interest

45) Bond Yields Vs. Gold Price

46) Gold Miners Bullish Percent Index Vs. GDX

47) Daily Sentiment Index Gold Vs. Gold Price

48) Commercial Net Short Interest Vs. Silver Price

49) Food Stamp Participation Rate Vs. Unemployment Rate

50) Bitcoin Price Vs. Gold Price

51) Credit Expansion Vs. Economic Health

52) Gold Volatility Vs. Gold Price

53) Total Stock Market Index Vs. GDP

Negative correlations:

1) Copper Price Vs. Copper Futures Contango

2) Interest Rates Vs. P/E ratio of gold mines

3) Non-Farm Payrolls Vs. Unemployment Rate

4) Federal Debt Held by Foreigners Vs. U.S. Bond Yields

5) Size of Governments Vs. Their Economies

6) Stocks Vs. U.S. Dollar

7) Silver Stock at CME Vs. Silver Price

8) China Reserve Requirements Vs. Shanghai Real Estate Prices

9) Capacity Utilization Vs. Unemployment Rate

10) Net Commercial Short Positions Vs. Bond Yields (Alternative Site)

11) Net Non-Commercial Long Positions Vs. Bond Yields

12) % Change in Gold Vs. Real Interest Rates on 10 Year Treasuries

These are a lot of correlations that you need to monitor on a day to day basis!

Comments

Post a Comment