Marc Faber Recommends Vietnamese Stocks

Remember Marc Faber recommending Vietnam? To go further on the case for investing in Vietnamese stocks in 2014, I wanted to point out several things.

First off, the savings rate in Vietnam is extremely high. We have 28% domestic savings rates and that's always a sign of a great economy. You can't produce and invest without savings.

Second, the inflation rate has come down from 20% in the past to 6% now. This will be great going forward as the dong (Vietnamese currency) will be stable going forward.

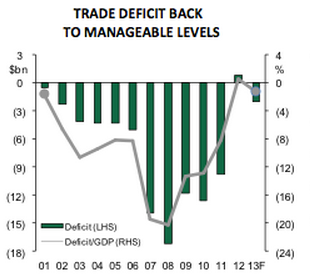

To point to a correlation on this blog, we know that the currency valuation is correlated to the trade deficit of a country and indeed, when we look at the trade deficit in Vietnam, we can see that Vietnam recently went into a surplus. This also explains why the dong is so strong lately and why the inflation rate is coming down.

To read further, go here.

First off, the savings rate in Vietnam is extremely high. We have 28% domestic savings rates and that's always a sign of a great economy. You can't produce and invest without savings.

Second, the inflation rate has come down from 20% in the past to 6% now. This will be great going forward as the dong (Vietnamese currency) will be stable going forward.

|

| Chart 1: Vietnam CPI |

To point to a correlation on this blog, we know that the currency valuation is correlated to the trade deficit of a country and indeed, when we look at the trade deficit in Vietnam, we can see that Vietnam recently went into a surplus. This also explains why the dong is so strong lately and why the inflation rate is coming down.

|

| Chart 2: Trade Deficit Vietnam |

To read further, go here.

Comments

Post a Comment