Bank Deposit Vs. Interest Rate

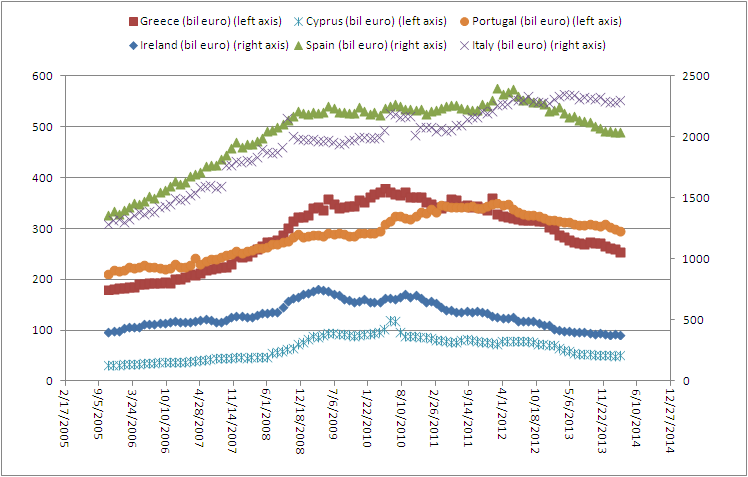

There is a very interesting correlation between bank deposits and the deposit interest rates that I haven't noticed yet. Whenever yields are low, be it that the government lowers interest rates or imposes taxes on deposits. The result is that people will flee out of bank deposits and move their money either into equities or gold. Or anything else for that matter. This is because investors are searching for yield on investment. If interest rates are low, they will find a better use for their money than putting it in a bank. Take Spain for example. Ever since the treasury yields peaked out in 2012, the same happened in the bank deposits in Spain. Spain 10 Year Yield As you can see here, the peak in Spain deposits (green chart) can also be found in 2012. Eurozone deposits